The crypto asset market is still growing in the Middle East and North Africa (MENA) region and requires dedicated time to study and fully understand it. Therefore, we have created this introduction to the digital asset trading on BitOasis Pro in an effort to help you better understand it.

What is a market

A market is a place where buyers and sellers exchange goods or services with each other. BitOasis Pro is just that – a place that connects buyers and sellers who want to exchange FIAT (AED) and 12 types of digital assets. We do this through an orderbook.

What is an orderbook?

In order for you to trade digital assets on BitOasis Pro, you need to sign up for a verified account. We do this to ensure all our customers are vetted so they can transact securely on BitOasis. Once you have a verified account, you gain access to our orderbook, through which you can enter orders.

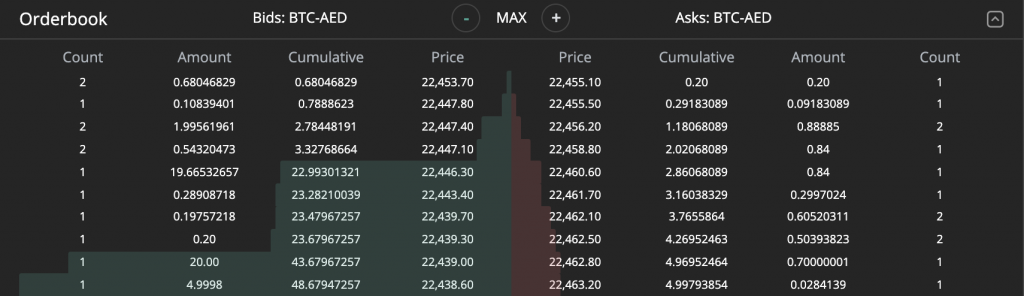

Once BitOasis receives an order from you, the order is transmitted to the orderbook, where your order will be separated into bids (buys), and asks (sells) for immediate execution, or execution at a point you set in case of Limit, Stop and Stop-Limit Orders (for more information on the different types of orders, please see the example below).

In the figure above, you can see the bids on the left of the orderbook, and the asks on the right. By looking at the highest bid, also called the market bid or best bid, and the lowest ask, also called the market ask or best ask, you get an indication of the market rate.

The difference between the best bid and best ask is called the bid-ask spread, which can tell you how efficient and active a market is. A high or wide bid-ask spread shows that the bid and ask prices are far apart and might indicate that the buyers and sellers willing to trade are fewer generally. A low or narrow bid-ask spread shows that the bid and ask prices are quite close together and might indicate that there are more buyers and sellers willing to trade.

What are trades?

Trades take place when bids and asks are confirmed; also known as executions, trades are considered complete, or an executed order, when abid or an ask finds a counterpart.

BitOasis Pro allows you to look up every trade that took place in the past under the Trade History tab.

The BitOasis Pro trade history indicates the amount of the digital asset that was traded, the price at which a trade was executed, whether it was a bid or ask (green indicates bid and red indicates ask), and the time each trade was executed for the digital asset you select.

Trading orders on BitOasis Pro

The types of orders you can execute on BitOasis Pro allow you to indicate whether you are a buyer or seller, what AED or digital asset you want to exchange, how much of the AED or digital asset you want to exchange, and what price you want to exchange it at. You can do this through the following order types:

Market Orders

This order type allows you to trade at the market price that is available at the time you are placing the order.

Limit Orders

This order type gives you the flexibility to enter at which price you want your orders to be executed. Your order will be executed automatically only when the market reaches the price you entered.

Stop Orders

This order type allows you to automatically trade digital assets at the market price you select in order to prevent excessive loss. Once the specific price is reached, your order instantly changes to a Market Order

Let’s say you place a Stop sell order for an asset you hold at the price of 27,000 AED. Once the price of the asset reaches 27,000 AED, the order is automatically changed to a market order.

Note: the platform will execute the sell order based on the available orders on the orderbook, not on the price specified in the stop field. The stop field here works as a trigger and not as a price. If you would like to buy/sell your assets at a specific price, please refer to the limit order above

In order to successfully place a buy stop order, please ensure your stop price is higher than the current buy price.

In order to place a sell stop order, please ensure your stop price is lower than the current sell price.

Stop Limit Orders (Advanced)

This order type is a combination of a “Stop” order and a “Limit” order. It allows your trade to be executed at a price specified by you. Once the stop price threshold is reached, your Stop Limit order will automatically change to a limit order.

Stop Limit Sell Order Example:

Consider the current price of an asset to be 27,000 AED and you think – based on your analysis – that the market will move to a downward movement once the price reaches 26,000 AED. If this case occurs, you would like to sell your assets at the price of 24,000 AED in order to prevent losses.

The stop (26,000 AED) is the trigger. If you set it lower than the current price (27,000 AED), then when the price of the digital asset reaches that point, it will trigger the limit sell order. The limit field (24,000 AED) is the price of the order that will be placed when the (Stop) is triggered.

Stop Limit Buy Order Example:

Consider the current price of an asset to be 27,000 AED and you think – based on your analysis – that the market will move to an upward movement once the price reaches 28,000 AED. If this case occurs, you would like to buy assets at the price of 28,500 AED to invest or hold.

The stop (28,000 AED) is the trigger. If you set it higher than the current price (27,000 AED), then when the price of the digital asset reaches that point, it will trigger the limit buy order. The limit field (28,500 AED) is the price of the order that will be placed when the (Stop) is triggered.

Keep track of all news and updates on our Blog and follow us on our Twitter, Facebook, Telegram, Medium as well as Reddit accounts for the latest updates.

Read More

- Stablecoin Market Reaches $200 Billion in Value

- Donald Trump Names David Sacks as Cryptocurrency and AI Advisor

- New Tokens Added: PEPE, BONK, TURBO & More!

- BitOasis Granted Full Virtual Asset Service Provider License by Dubai’s Virtual Assets Regulatory Authority

- Ripple and Archax Partner to Tokenize Major Liquidity Fund

- Understanding Spot Bitcoin ETF Options and Their Role in Evolving Crypto Markets