We’re glad to announce that BitOasis Pro has a new order type our users have been asking for: OCO orders. With this new order type, you can get prepared for the different direction the market might take, by placing two orders for the same balance.

What’s an OCO order?

OCO is short for “One-Cancels-the-Other”. In other words, an OCO order is technically two orders: a limit and a stop order, and when one of the trigger prices is met and one of the two orders is executed, the other order will be automatically canceled.

This way you’ll make sure you’re prepared for several scenarios, and that the trade that best suits the market conditions will be executed.

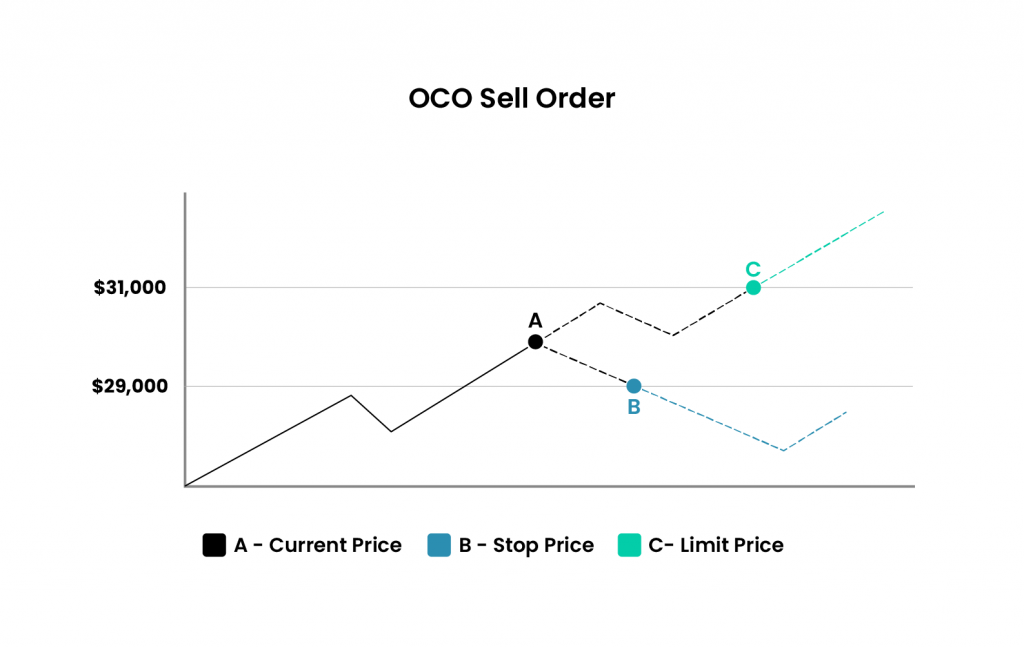

How to use an OCO order to sell crypto?

For example, you’ve bought 1 BTC at $30,000. You want to make sure to collect your target profit of $1,000, but at the same time, you want to make sure you have a stop-loss order in place to protect you from losing more than $1,000. Here’s what you do:

- From BitOasis Pro you select Sell.

- Choose OCO.

- Set the limit price to $31,000.

- Set the stop price to $29,000.

- Set the amount you’d like to sell.

What happens next will be one of two scenarios:

- If Bitcoin’s price hikes to $31,000, your limit order gets executed, while your stop order gets canceled automatically.

- If Bitcoin’s price drops to $29,000, your stop order gets executed, while your stop order gets canceled automatically.

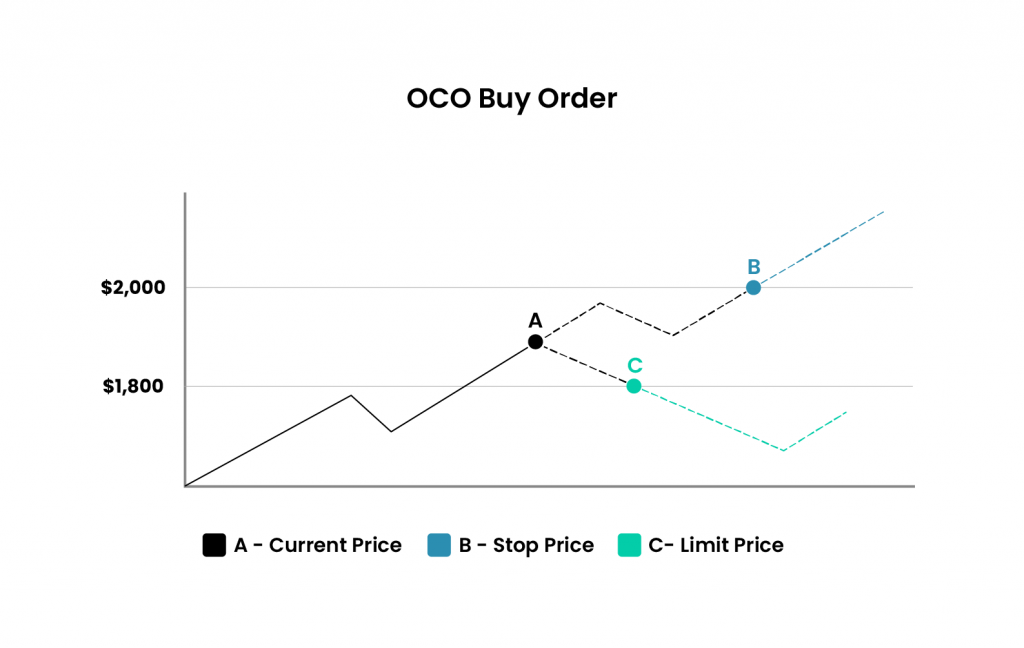

How to use an OCO order to buy crypto?

For example, you think, based on your own analysis, that Ethereum ($1,900) looks like a promising investment right now. You want to wait to get it for a reduced price of $1,800, but at the same time, you think if it breaks through the $2,000 mark, it’s going to make extra gains and you want to make sure you buy some to make a profit. Here’s what to do:

- From BitOasis Pro you select Buy.

- Choose OCO.

- Set the limit price to $1,800.

- Set the stop price to $2,000

- Set the amount you’d like to buy.

After you’ve done that, one of the two orders will be processed as per the following:

- If Ethereum’s price drops to $1,800, your limit order gets executed, while your stop order gets canceled automatically.

- If Ethereum’s Price hikes to $2,000, your stop order gets executed, while your stop order gets canceled automatically.

Important Notice: BitOasis does not provide investment or legal advice. If this content, including attachments, contains guidance or expresses a view, this is not to be considered or relied upon as investment or legal advice and it is recommended that you obtain independent professional advice. Cryptocurrency trading/investing involves a substantial risk of loss and may not be suitable for every investor. If you do not fully understand these risks, you must seek independent advice from your financial advisor.