As we near the end of this significant year for bitcoin, alts, and DeFi, we figured it was time to look back. And, alongside this growth in cryptocurrencies, we reached some milestones too.

Further, trading volumes on BitOasis exceeded $3 billion with a doubling of customers. Keeping our growing user base in mind, we set up a local bank funding option, taking deposit fees on the platform down to zero. We also upgraded our product offering and launched 12 new altcoins recently. This brings us to our next segment:

How 2021 became the year of Altcoins

According to internet searches in 2021, Altcoins were quite the rage. This year’s Google Trends report revealed that “Dogecoin” is in 2021’s top five most searched terms in the news category. But when it comes to the top 10 global cryptocurrencies, DOGE still lags behind. However, investors holding DOGE between 1-12 months has increased over the year, seen below.

Looking Ahead

DOGE ‘cruisers’ could have increased possibly because they’re expecting another price rally. At the same time, Dogecoin Foundation is working towards a plan to enhance Dogecoin’s utility, and make it more accessible for everyday use, which could further increase DOGE HODlers.

Meanwhile, Decentraland’s MANA reached new all-time highs, increasing from $2 to about $4.5 this year, alongside ‘Land’ value that skyrocketed after investors realized the potential of the Metaverse. In November, these virtual plots of land were sold for 56,000 MANA tokens, worth about $184,240 at the time. More bullish news followed, as the nation of Barbados said it was preparing to establish a virtual embassy in Decentraland’s metaverse, connecting international diplomacy and digital real estate.

What’s next for DeFi: Will AAVE take the lead

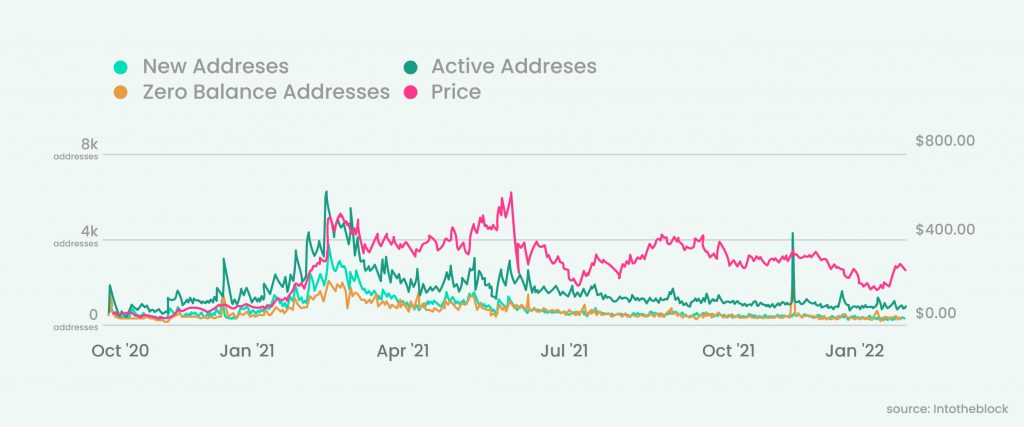

AAVE, one of the biggest lending protocols, noted the highest weekly gains of 57.60%. With a 3x rise in Total Value Locked from around $5 billion in April to around $15 billion now, the DeFi protocol has also been very active on-chain. In the past week new AAVE addresses saw a 37% jump, while active addresses increased by 18% as seen below:

Overall, DeFi has a market dominance of 18%, with a total value locked worth $102.79 billion – a sharp increase from last year’s $24 billion.

Looking Ahead

A fact that can’t be disregarded is the increase in cybercrimes that plagued the DeFi sector this year. Over $10 billion of DeFi value lost was lost in rug pulls, ransomware attacks (where hackers demand bitcoin as ransom), and other exploits that have reignited talks on blockchain security. But, DeFi is expected to attract more institutional involvement which could increase the demand for insurance protections for companies investing in the space. So far, decentralized brokerage Armor ranks first, with $635.97million in TVL, followed by Nexus Mutual (TVL $587.62 million).

Latest on geopolitics of crypto

Several countries were busy with digital currencies this year. Some began experimenting with Central Bank Digital Currencies (CBDCs) that are set to standardize crypto regulations. While China declared all crypto transactions as illegal. Meanwhile, El Salvador became the world’s first nation to adopt bitcoin as legal tender with plans to establish a “Bitcoin city.”

Looking ahead

Geographical situation looks favorable for crypto with 2021 global crypto adoption increasing by over 2300% since Q3 2019. Many in emerging markets turned to cryptocurrency to preserve their savings in the face of inflation, while adoption in developed regions was driven by institutional investment. In the region, Dubai aims to boost its digital economy and expects over 1,000 crypto companies to be operational by 2022.

Here’s why bitcoin mining may remain highly profitable next year

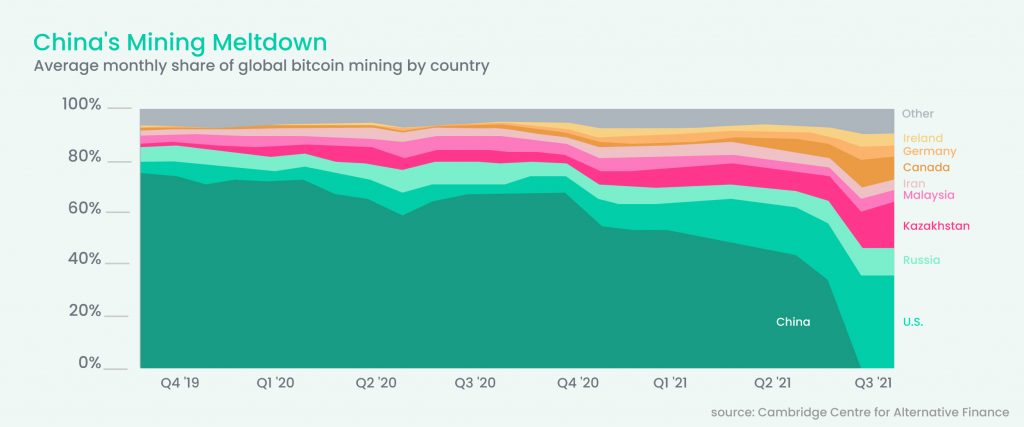

Mining sector was in the news this year after U.S. became the top destination for Bitcoin miners, overtaking China, which was the market leader in hasrate (total computing power of miners). Mining companies in China faced state level restrictions and most of them left for North America, in search of cheap sources of energy.

So far, the current hashrate of 178.01 million indicates that Bitcoin mining network has had a significant increase from 134.18 million one year ago. This is a change of roughly 20% from last year as seen below:

Until November, there was a growth in mining returns, but, since then, profitability in this sector has been declining. Moreover BTC average difficulty has increased in the last three months and is currently 24.27T, up from 18.67T one year ago. This is a change of roughly 30% from last year.

Looking Ahead

Despite the fall in revenue, mining remains highly profitable because the price of bitcoin has increased faster than the hashrate. So far, bitcoin miners have made over $15.3 billion in revenue, representing a year-on-year increase of 206%, a record year. Ethereum miners on the other hand have generated a total revenue of $16.5 billion, representing a year-on-year increase of 678%, a record revenue year. Large ETH miner revenues are expected from the network’s transaction fees, which could increase in response to more NFT activity in the future.

Speaking of NFTs

NFT became hugely popular this year, but as with any trend, people get bored eventually. But this certainly doesn’t mean the end for NFTS, especially when there is a huge demand for tokens that offer ownership rights for digital products. NFT market has a current volume of $20 billion, with sales volume worth about $2.5 billion this year. This is an increase from roughly $13 million in the first half of 2020.

We hope you have a great year ahead! Stay tuned for our next post to find out more.